When it comes to protecting against identity theft, LifeLock is a name almost everyone recognizes. For years, it has been a household name in personal identity theft protection, offering individuals peace of mind by monitoring their personal information, credit, and financial accounts. However, as a business owner, you need to understand a critical distinction: LifeLock and similar personal services are designed to protect you, the individual—not your business.

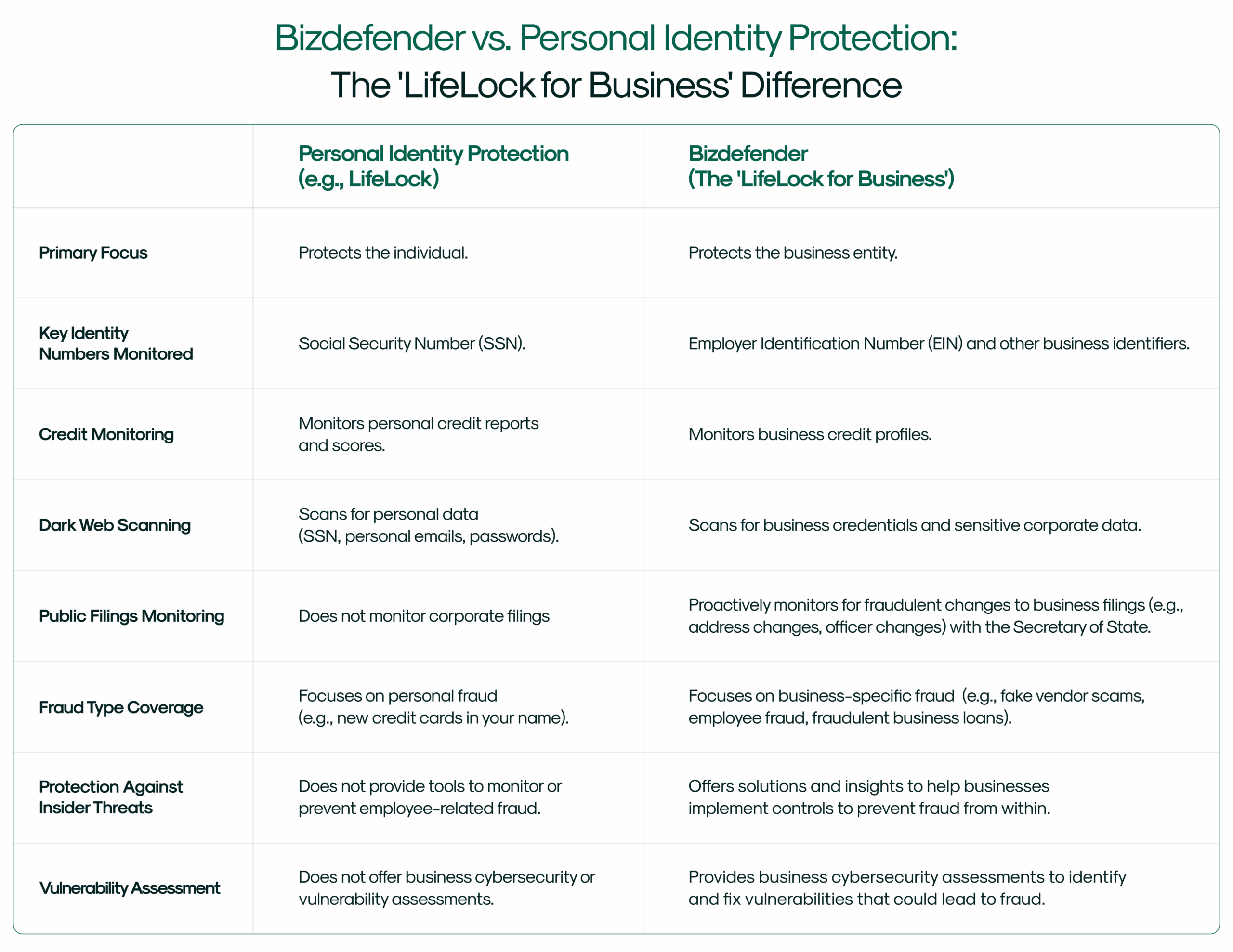

This is where Bizdefender steps in. We are often described as “LifeLock for business,” and for good reason. While a personal plan guards your Social Security Number, personal bank accounts, and credit score, a business needs a different kind of armor. Your business has its own identity, its own credit profile, and its own unique set of vulnerabilities that a personal plan simply doesn’t cover. This article will break down the key differences between personal and business identity protection, explain why Bizdefender is the essential solution for your company, and show you how to build a robust Business Fraud Protection strategy that protects both your personal and professional life.

What Do Personal Protection Services Like LifeLock Actually Cover?

LifeLock is a leader in personal identity protection, and its services are excellent for what they are designed to do. A typical plan for an individual includes:

- Personal Credit Monitoring: They monitor your credit reports and scores from one or more of the major credit bureaus (Equifax, Experian, and TransUnion). This is crucial for detecting new credit accounts or loans opened in your name.

- Personal Data Monitoring: They scan the dark web for your personal information—your Social Security Number, email address, and passwords—that may have been exposed in a data breach.

- Financial Account Alerts: They send alerts for suspicious activity on your personal bank accounts, credit cards, and investment accounts.

- Identity Restoration: If you become a victim of identity theft, they provide a team of specialists to help you restore your identity.

These services are vital for protecting you from personal identity theft. They are your first line of defense against someone using your name to open a credit card or a new bank account. However, this is a narrow focus that leaves your business exposed to a world of different threats.

Why a Personal Plan Doesn’t Protect Your Business

Your business has its own identity, separate from your personal one. It has an Employer Identification Number (EIN), corporate bank accounts, business credit lines, and public filings that are not monitored by personal protection plans. Relying on a personal plan for business security is like trying to protect a fortress with a single lock on the front door.

- Business Identity Theft vs. Personal Identity Theft: A fraudster might not be after your personal credit score; they might be after your business’s. They can use your company’s name and EIN to open fraudulent business accounts, apply for credit lines, and even file fake tax returns. This can cripple your company’s credit and financial health.

- Lack of Business-Specific Monitoring: LifeLock doesn’t monitor your business’s name or EIN on the dark web, nor does it track changes to your business’s public filings. A criminal could file a fraudulent change of address for your company with the Secretary of State, reroute your mail, and intercept financial documents—all without triggering an alert from a personal plan.

- Employee and Vendor Fraud: A personal plan offers no protection against insider threats or scams involving fraudulent vendors. It won’t alert you if an employee is embezzling funds or if a fake supplier is trying to get paid. These are business-specific threats that require a different set of monitoring and controls.

Why Bizdefender is the “LifeLock for Business”

Bizdefender was created specifically to fill the crucial gap left by personal identity protection services. We provide a holistic solution that focuses on the unique vulnerabilities of a business. Our services are designed to protect your company’s financial health, reputation, and operational integrity—all of which are separate from your personal identity.

- Proactive Business Filings Monitoring: Your company’s identity is defined by its public records. We monitor those filings for any unauthorized changes or new registrations that could indicate fraud. This is a level of protection no personal service provides. Our proactive business filings monitoring is a critical line of defense against business identity theft.

- Comprehensive Business Fraud Protection: We go beyond simple credit monitoring. Our solutions are built to detect a wide range of fraudulent activities, from vendor scams and invoice manipulation to employee fraud. We understand that Business Fraud Protection requires a multi-layered approach that includes both technology and process-based controls.

- Free Dark Web Scan for Business: While personal plans scan the dark web for your personal data, we provide a free dark web scan that looks for compromised business credentials, such as employee emails, passwords, and other sensitive corporate data that could be used to launch a cyberattack or fraud scheme.

- Affordable and Accessible for All Businesses: We believe that robust protection should not be a luxury reserved for large corporations. Our solutions are made simple and affordable for business operators of all types, ensuring that small and medium-sized businesses can access the same level of protection as their larger competitors.

Building a Comprehensive Security Strategy with Bizdefender

The best way to protect yourself and your business is to combine the strengths of both personal and business identity protection. A personal plan protects your individual identity, and Bizdefender protects the identity and financial health of your company.

- Protect Yourself: Maintain a strong personal identity protection plan to monitor your personal credit and accounts.

- Protect Your Business: Implement a robust business protection plan with Bizdefender to monitor public filings, business credit, and employee-related risks.

- Holistic Cybersecurity: Understand that fraud and cybersecurity are intertwined. Use our services like the business cybersecurity assessment to identify vulnerabilities that could lead to a fraud attack.

- Educate Your Team: Train your employees on how to spot phishing attempts and other scams, using resources like our phishing prevention guides.

You wouldn’t use a bicycle helmet to protect a race car driver. Likewise, you can’t rely on a personal identity protection plan to protect your business. Bizdefender is the dedicated solution for Business identity theft protection. We provide the specialized tools and expertise you need to safeguard your company from the unique threats it faces. Don’t let a personal plan leave your business exposed. Discover the Bizdefender difference and start protecting your company’s future today.

FAQ

What is the biggest difference between personal and business identity protection?

The biggest difference is the focus of the monitoring. Personal plans like LifeLock protect the individual’s credit and personal information. Business plans like Bizdefender protect the business’s identity, including its EIN, public filings, and corporate credit profile.

Can’t I just get a personal plan that covers my business?

No. Personal identity protection services do not offer the specific monitoring needed to protect a business. They will not track fraudulent changes to your corporate filings, monitor your business credit, or provide the tools necessary to prevent business-specific scams like fake vendor fraud.

What is business identity theft?

Business identity theft is when a fraudster uses your company’s name, EIN, or other information to commit fraud. This can include opening fraudulent credit lines, filing fake tax returns, or taking over your company’s bank accounts.

How does Bizdefender help with business identity theft protection?

Bizdefender offers a range of services specifically for businesses, including proactive monitoring of business filings, dark web scans for corporate credentials, and resources for preventing fraud. Our goal is to protect the unique identity of your company.

What is an EIN, and why is it important to protect?

An EIN, or Employer Identification Number, is a unique nine-digit number assigned by the IRS to a business entity. It’s like a Social Security Number for a business. Protecting your EIN is critical because a fraudster can use it to impersonate your business and commit financial fraud.